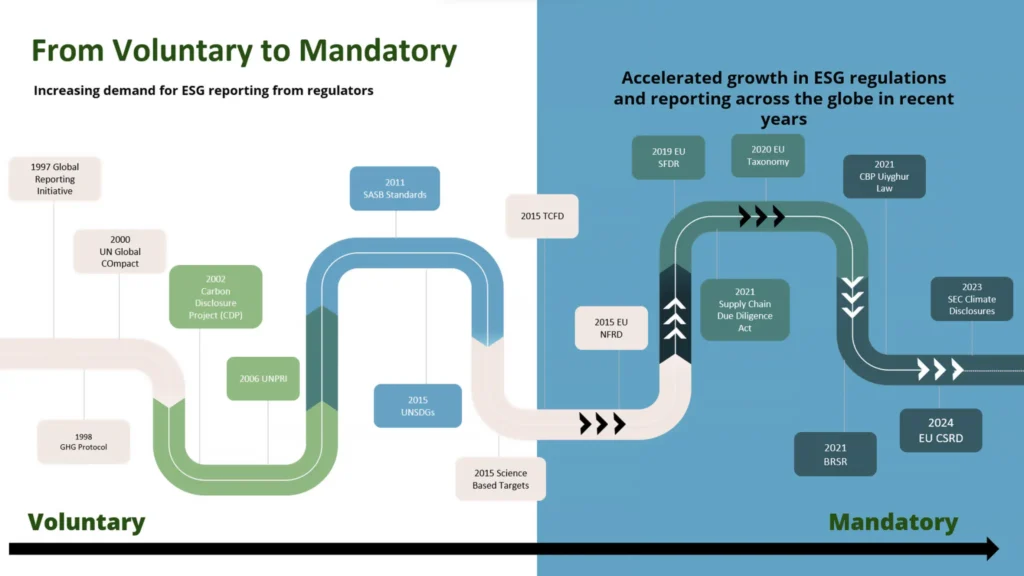

In the world of responsible business practices, ESG (Environmental, Social, and Governance) reporting has emerged as a critical tool for measuring and disclosing the impact of companies beyond their financial performance. While many are familiar with ESG reporting, understanding its journey from voluntary adoption to becoming a mandatory requirement sheds light on its significance in today’s corporate landscape.

The Rise of ESG Reporting

Early on, visionary companies recognized the importance of sustainability, adopting ESG reporting voluntarily. They understood that their responsibilities extended beyond maximizing profits, encompassing environmental stewardship, social responsibility, and strong governance. ESG reporting served as a means to transparently communicate their efforts in these areas.

This early adoption was primarily driven by socially responsible investing. Investors started seeking companies that aligned with their ethical values and demonstrated sustainable practices. This led to a wave of interest in ESG reporting, as companies saw the value in appealing to this growing investor base.

Key Events in the Evolution of ESG Reporting

-

1997 – The Birth of Common Ground: Global Reporting Initiative (GRI)

The launch of the Global Reporting Initiative (GRI) marked a turning point. As a collaborative effort, the GRI aimed to establish a unified framework for ESG reporting. This initiative laid the foundation for standardization and comparability across reporting practices.

-

1998 – Navigating Emissions: Greenhouse Gas Protocol (GHG Protocol)

The establishment of the Greenhouse Gas Protocol (GHG Protocol) was instrumental in providing a standardized approach to quantify and report greenhouse gas emissions. Jointly formed by the World Resources Institute (WRI) and the World Business Council for Sustainable Development (WBCSD), this protocol became a linchpin for emissions accounting.

-

2002 – Unveiling Carbon Insights: Carbon Disclosure Project (CDP)

In 2002, the Carbon Disclosure Project (CDP) was established. This non-profit entity focused on collecting and disseminating information related to corporate carbon emissions, climate change vulnerabilities, and opportunities. The CDP facilitated the integration of climate considerations into business strategies.

-

2006 – Investing Responsibly: United Nations Principles for Responsible Investment (UNPRI)

The introduction of the United Nations Principles for Responsible Investment (UNPRI) added a new dimension to ESG reporting. Targeted at investors, these principles promoted the integration of ESG factors into investment decision-making processes.

-

2011 – Industry-Specific Disclosure: Sustainability Accounting Standards Board (SASB)

The Sustainability Accounting Standards Board (SASB) was instituted as an independent organization responsible for developing and maintaining industry-specific standards for ESG disclosure. These standards focus on ensuring relevant, reliable, and comparable reporting practices.

-

2015 – Global Goals for Progress: United Nations Sustainable Development Goals (UNSDGs)

The adoption of the United Nations Sustainable Development Goals (UNSDGs) in 2015 outlined a universal agenda for promoting social, economic, and environmental well-being by 2030. These goals provided a shared framework for organizations to align their ESG efforts.

-

2015 – Science-Based Targets: Science Based Targets initiative (SBTi)

Launched as a collaborative endeavor between CDP, WRI, WWF, and the UN Global Compact, the Science Based Targets initiative (SBTi) aimed at assisting companies in setting ambitious, science-backed emission reduction targets in alignment with the Paris Agreement.

-

2015 – Financial Climate Insights: Task Force on Climate-related Financial Disclosures (TCFD)

The Financial Stability Board’s establishment of the Task Force on Climate-related Financial Disclosures (TCFD) led to the formulation of voluntary recommendations for consistent and comparable disclosure of climate-related financial risks and opportunities.

-

2015 – Regulatory Mandates: European Union Non-Financial Reporting Directive (EU NFRD)

The European Union Non-Financial Reporting Directive (EU NFRD) was adopted as a regulation necessitating large EU public-interest entities to incorporate ESG policies, risks, and outcomes into their annual reports.

-

2019 – Integrating ESG: European Union Sustainable Finance Disclosure Regulation (EU SFDR)

The European Union Sustainable Finance Disclosure Regulation (EU SFDR) mandated financial market participants and advisers within the EU to disclose their integration of ESG factors into investment decisions and advice.

-

2020 – Environmental Classification: European Union Taxonomy Regulation

The European Union Taxonomy Regulation established a classification system for economic activities contributing to environmental objectives, fostering clarity and accountability.

-

2021 (India) – Holistic Business Accountability: Business Responsibility and ESG Report (BRSR)

Introduced in India, the Business Responsibility and ESG Report (BRSR) required listed companies to disclose ESG performance based on principles drawn from the National Guidelines on Responsible Business Conduct.

-

2021 (US) – Combatting Forced Labor: Uyghur Forced Labor Prevention Act –

The Uyghur Forced Labor Prevention Act prohibited imports from the Xinjiang region unless evidence demonstrated the absence of forced labor, underscoring the importance of ethical supply chains.

-

2023 (US) – Strengthening Climate Disclosures: Securities and Exchange Commission (SEC) Directives

Anticipated to be a landmark year, the Securities and Exchange Commission (SEC) is poised to issue enhanced climate disclosure rules for public companies in response to President Biden’s directive.

-

2024 – Enhancing Corporate Reporting: European Union Corporate ESG Reporting Directive (EU CSRD)

The forthcoming European Union Corporate ESG Reporting Directive (EU CSRD) is expected to bolster ESG reporting by expanding the scope, content, and assurance requirements for large EU companies.

The Transition to Mandatory Reporting

The journey of ESG reporting has evolved from a voluntary exercise to a mandatory obligation. Governments and regulatory bodies around the world have recognized the value of ESG data in assessing corporate performance. As a result, they’ve implemented regulations that require companies to report their ESG metrics and strategies.

The evolution of ESG reporting highlights the transformation of a once-niche practice into a global standard. From its early roots driven by ethical investments to today’s regulatory landscape, ESG reporting is a testament to the corporate world’s commitment to sustainability. As businesses continue to evolve, ESG reporting will remain a cornerstone, promoting transparency, accountability, and a positive impact on the world.

Stay updated with the ever-evolving landscape of ESG reporting and its impact on business practices. Explore key events, regulatory shifts, and the journey from voluntary to mandatory reporting in this comprehensive guide.