This blog post explores how Saudi Arabia can leverage Environmental, Social, and Governance (ESG) principles to green across all sectors, attract investments, and support its long-term development goals.

Introduction

In recent years, ESG factors have become critical criteria for companies seeking to align financial goals with sustainability and responsible practices. Countries worldwide are integrating ESG into their financial systems, and the kingdom is no exception. With Saudi Vision 2030 and its economic diversification commitment, the kingdom has a unique opportunity to embrace ESG principles and pave the way for a transparent and sustainable future.

Developing ESG Consciousness and Educational Initiatives

The first step is to raise awareness and educate stakeholders, including employees, suppliers, investors, financial institutions, government entities, and the public. Prioritizing Sustainability and ESG principles can generate interest and drive a move toward responsible practices.

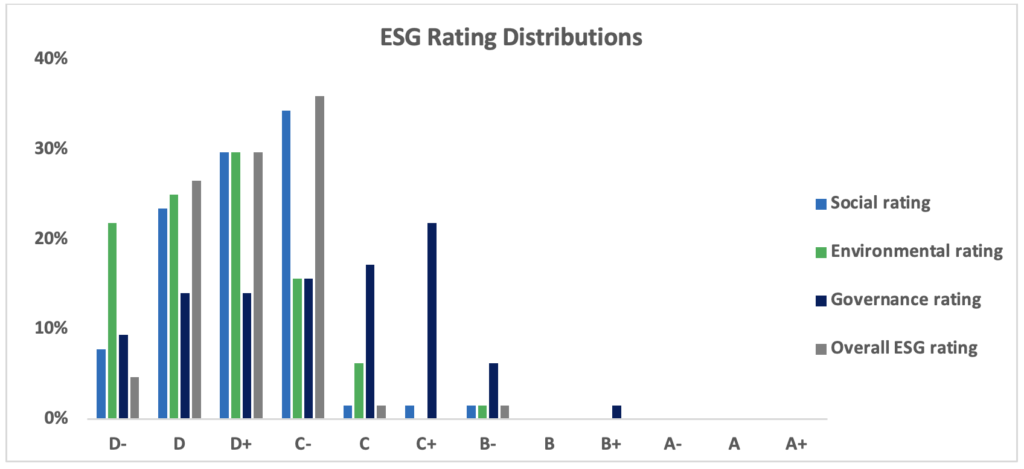

ESG Rating Distributions for Middle Eastern Companies

Source: ISS ESG

Developing ESG Regulations and Reporting Standards

To ensure transparency and accountability, Saudi Arabia is in the process of developing Sustainability and ESG regulations and reporting standards. Collaboration between regulatory bodies like the Saudi Arabian Monetary Authority (SAMA), the Saudi Exchange (Tadawul), and the Ministry of Environment, Water, and Agriculture is crucial. Clear guidelines for ESG reporting and disclosure will provide investors with reliable information for informed decisions based on companies’ environmental and social performance.

In 2018, the Saudi Exchange (Tadawul) partnered with the UN Sustainable Stock Exchanges Initiative. This collaboration aimed to promote awareness of ESG practices and encourage the adoption of sustainable business practices. Through diverse channels, the Exchange has worked towards advancing ESG disclosure in the Saudi capital market. Acknowledging its role in supporting ESG progress in The Kingdom and the broader region, the Exchange continues to emphasize the importance of ESG-related information disclosure by listed companies.

The Growing Importance of ESG in Saudi Arabia

Several factors contribute to the growing importance of ESG in the kingdom:

- Saudi Vision 2030: This national development plan prioritizes sustainability and economic diversification, emphasizing responsible and sustainable practices across sectors, including finance and investments.

- Regulatory Support: Regulatory bodies are taking steps to support ESG integration with guidelines and reporting standards promoting transparency.

- Investments in Sustainable Projects: Significant investments in renewable energy and initiatives like the Saudi & Middle East Green Initiatives reflect the country’s commitment to a greener future.

- Market Demand and Investor Expectations: There’s a growing global demand for sustainable investments, and Saudi Arabia is no exception. Investors are increasingly considering ESG factors in their decisions, driven by financial considerations and environmental/societal concerns.

- International Collaborations and Partnerships: The kingdom actively participates in international collaborations focused on sustainable finance and ESG integration. These partnerships enable knowledge sharing, best practice exchange, and capacity building.

- Corporate Responsibility: Companies recognize the benefits of integrating ESG principles, considering their environmental, social impact, and governance practices to enhance reputational value, attract responsible investors, and mitigate potential risks.

What ESG Metrics are Critical for Saudi Businesses?

While specific metrics may vary, some key ESG metrics are widely recognized for evaluating business sustainability and responsible practices:

- Environmental Metrics: Greenhouse gas emissions, energy consumption, water usage, and waste management.

- Social Metrics: Employee health and safety, diversity and inclusion, labor practices, and supply chain management.

- Governance Metrics: Board diversity and independence, transparency and disclosure, ethics and anti-corruption practices, and executive compensation and incentives.

Saudi businesses should identify industry-specific ESG metrics and continuously monitor and report on them to demonstrate commitment to sustainable practices and meet stakeholder expectations.

Building Bridges for a Sustainable Future

Collaboration and partnerships are essential to pave the way for transparent and sustainable practices in The kingdom. This requires engagement between various stakeholders, including financial institutions, companies, government entities, and international organizations. Collaborative efforts can focus on developing Saudi & Middle East Green Initiatives, promoting sustainable business practices, and sharing best practices in ESG implementation. Partnerships with international organizations can provide expertise and resources, accelerating Saudi Arabia’s transition towards an environmentally responsible financial system.

Supporting Green Projects and Infrastructure

The kingdom has already taken steps towards sustainable development with initiatives like the Saudi & Middle East Green Initiatives. Leveraging ESG principles can attract investments in renewable energy projects, environmentally friendly infrastructure, and sustainable businesses. By providing financial incentives and support to green initiatives, The kingdom can create a robust ecosystem for sustainable finance and contribute to global efforts to combat climate change.

ESG Reporting Standards and Frameworks

Here are some of the common ESG reporting options:

- Global Reporting Initiative (GRI)

- Task Force on Climate-related Financial Disclosures (TCFD)

- United Nations Sustainable Development Goals (UNSDGs)

- Carbon Disclosure Project (CDP)

- Integrated Reporting

These are just a few examples of ESG reporting options available to companies. The choice of reporting framework often depends on the company’s industry, stakeholder expectations, and regional regulations. Many companies also use multiple reporting options to provide a comprehensive view of their ESG performance.

How Saudi Companies Can Utilize ESG Disclosure?

Companies can take the following steps to ensure ESG disclosures:

- Educate and Raise Awareness: Provide training and education programs to familiarize stakeholders with ESG concepts, their relevance to the organization, and the benefits of incorporating ESG practices.

- Develop a Clear ESG Strategy: Create a robust ESG strategy aligned with the company’s mission, values, and long-term goals. Ensure clear communication throughout the organization.

- Enhanced Brand Positioning: Strong ESG practices enhance brand image, resonate with conscious consumers, reinforce loyalty, and attract new customers who value sustainability.

- Competitive Differentiation: Implementing ESG initiatives and demonstrating leadership in sustainability will set your company apart from competitors.

- Reduced ESG Risk: Implementing proactive measures to identify and mitigate ESG risks, protecting the company from potential financial, legal, and reputational impacts.

- Regulatory Readiness: Stay ahead of evolving ESG regulations and standards, ensuring compliance and positioning the company favorably in the regulatory environment.

- Regular Reporting and Communication: Implement a transparent and comprehensive ESG reporting framework. Regularly communicate progress on ESG goals

By adopting these strategies, companies can build trust, attract responsible investors, and promote long-term sustainability.

Credibl ESG, Your Partner in Streamlining ESG Reporting Journey

While various ESG reporting software options exist, Credibl stands out as a comprehensive solution designed to empower Saudi companies throughout their ESG journey.

Credibl goes beyond basic software by offering expert advisory, consulting, and reporting all under one roof. This simplifies the process for Saudi companies and ensures their ESG efforts are aligned with best practices and regulations. By leveraging Credibl ESG platform, Saudi companies can gain a multitude of benefits:

- Expert ESG Advisory: Credibl’s team of ESG specialists provides tailored guidance to navigate the complexities of ESG implementation.

- Streamlined Consulting: Their consultants work alongside your team to develop a robust ESG strategy aligned with your company’s goals and industry standards.

- Reduced Time and Cost: Automate tedious tasks and streamline reporting processes, freeing up valuable resources and saving on operational costs.

- Improved Data Accuracy and Consistency: Centralized data management and automated data collection minimize errors and ensure consistent reporting.

- Data-Driven Decision Making: Gain valuable insights from automated data analysis and reporting tools to inform strategic sustainability initiatives.

- Demonstrated Transparency and Accountability: Create comprehensive and transparent ESG reports, enhancing stakeholder confidence and trust.

Credibl ESG is committed to being your partner in achieving your ESG goals. We offer a robust and user-friendly platform that simplifies ESG reporting, empowers informed decision-making, and strengthens stakeholder relations. With Credibl ESG as your partner, you can navigate the ever-evolving ESG landscape with confidence and contribute to a more sustainable future for Saudi Arabia

Schedule a call with our ESG expert to jumpstart your ESG journey and unlock sustainable opportunities for your organization!